Toyota Industries Shares to fall short-term [2023.08.18]

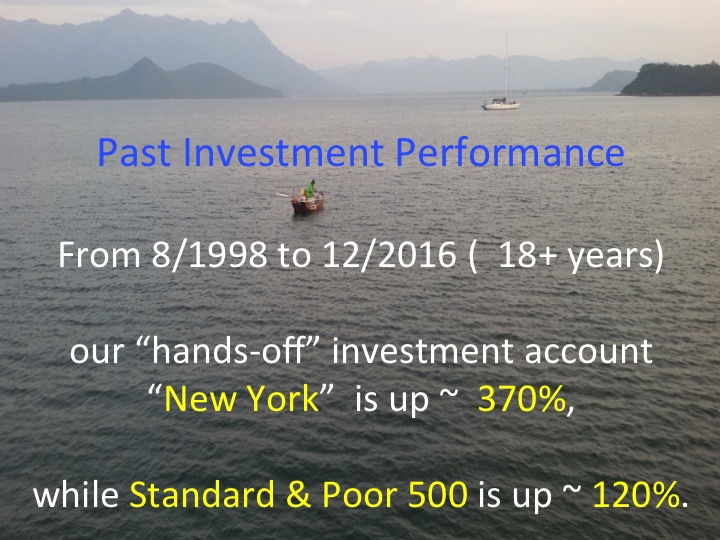

We are retail investors investing at spare times, and we have consistently surpassed the market as a whole over decades.

The following chart shows our investment performance in the past 9 years, as compared to Standard and Poor 500 index (S&P 500 index). It shows relative values of Account “New York” and S&P 500 index at the end of each year. The account value on Dec. 31, 2013 is set to be 100. The return has been higher than S & P 500 almost every year except in 2021.

While the methods we use in the past 20 years had produced steady growth, the return rates were not outstanding, so we started to experiment a few new methods to bring up the return rate, using totally different accounts and fundings and approaches.

While the results are astonishingly good in Year 2017 (+ 85% on average) and Year 2018 (+106% on average), the experimental method used in 2019 is not very good, as the return was extremely bad in Year 2019 (- 32%). For the whole of 2020, the gain was too astonishing to publish, probably the best in many years, but the results in Year 2021 was negative at – 15% !.

The total invested capital in the experiments is negligibly small. We will continue the experiments one more year.

Recent Comments