- John Maynard Keynes:

Markets can remain illogical longer than we can remain solvent.

- Warren Buffet:

Rule No. 1: Do not lose money.

Rule No.2: Do not forget Rule No. 1.

- To invest in individual stocks or the index?

In June 2014 we are convinced that the H shares (China State-owned enterprises listed on the Hong Kong stock exchange ) are about to take off. We then invest in both the H index and individual stocks. Now 8 months later, we analyze the results, and find that there is no much difference, click here to see the results (click to see the picture): IndexOrStocks20150309

- What do the financial numbers mean for a business ?

Return on assets (ROA) : this is particularly useful for established businesses . If the borrowing cost is like 7% (such as a corporate bond) , then a ROA like 10% means the business can earn 10% on the operational assets (or total assets), and the business can keep 10% – 7% = 3%. Then the company management can borrow more money to expand the business.

Return on equity (ROE): if the company has no borrowing, then equity is just assets, and ROE = ROA.

As in the above example, when the company borrows money (either from a bank or from issuing bonds), then Equity = Asset – Loan , so ROE is higher than ROA. It shows how efficient the company management uses capital.

Loan to value ratio (LTV) = Loan / Asset x 100% = Loan / (Equity + Loan) . It is more conservative to keep it < 30 %. If LTV > 60%, the management is engaging a lot of more risk, unless the business AHEAD is going to be very promising and ROA will be high (>10%), the business is risky. Many real estate developers use a very high LTV to expand the business, especially when the property market is booming.

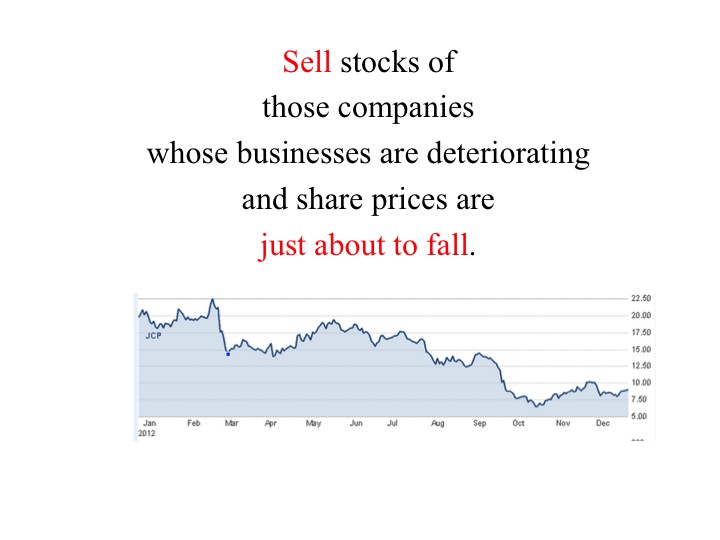

Revenue : It should keep going higher and higher each year, otherwise the business stalls and problem comes. If it starts to drop consistently , it shows the customers do not like the products and the business is losing steam !

Net profit : how much the company earns after a hard-working year .

Net profit margin: Net profit / revenue x 100% shows if the business is a profitable one. If it is below 10%, the business is not a strong one, any change in the business conditions (like price drop, declined sales, interest rates rise, etc. ) may derail the business. If it is > 20%, it is very good !

Operational profit margin: this has to be good, better >20%, ideally > 35%.

Cash flow: if cash flow is positive, the management has an easy life. When a company invests in R&D or in production capacity, a lot of cash is used, so cash flow may not be positive for a short time. When these activity is reduced (such as a new production line or factory starts to be fully operational), cash flow then will become positive again (assuming the new products are still in good demand and very profitable.)

Investing in Growth Stocks

read at https://www.fool.com/investing/stock-market/types-of-stocks/growth-stocks/

Whitney Tilson: Lessons from my investment in Amazon 2 decades ago

https://finance.yahoo.com/news/whitney-tilson-lessons-investment-amazon-2-decades-ago-131353651.html

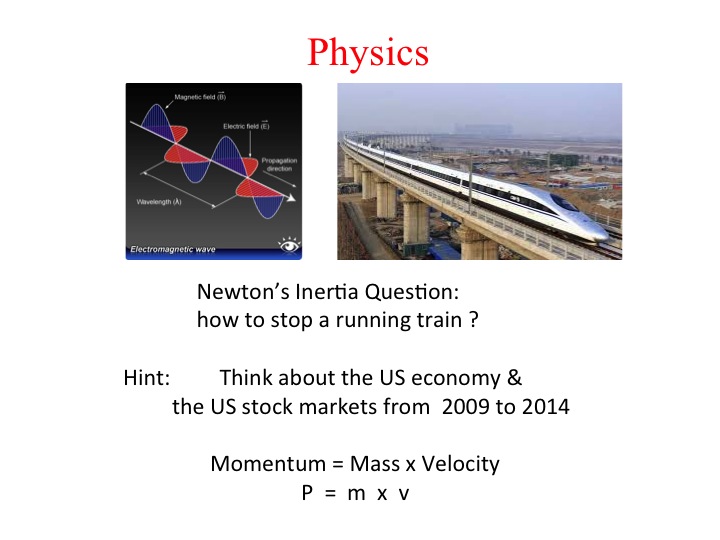

What makes the stocks, as a whole, move up when the economy is not surely strong ?

It is a choice of two competitors for cash yield: risk-free deposit (or borrowing) rate and stock yield.

The former is typically reflected US FED interest rates and manifested in bond yields; while the latter is S&P 500 yield as a whole.

A typical demonstration is the US market after the global financial crisis in 2008/2009 : the economy was not strong at all from early 2009 to later part of 2016, but the US stock markets have been marching strongly upward, almost unstoppable ! Why ?

Because cash is so cheap: FED rate is close to 0. If one has cash, putting it in bank does not earn any meaningful income. If one borrows at a cheap rate, and buys stocks with steady yield (such as blue chip stocks), one makes profit from the yield – rate difference, and also makes profit from rising stock prices.

Pyramiding Into A Stock Helps Minimize Buying Risk

Read More At Investor’s Business Daily: http://education.investors.com/investors-corner/777900-pyramiding-into-stock-minimizes-risk.htm#ixzz3pxksHFCI

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

Buying high-yield dividend stocks : potential problems

High-yield stocks are constantly in demand due to investors’ appetite for income. Demand increases during turbulent economic conditions, as fear becomes the primary emotion in investors’ minds and expectations of lower interest rates make dividends more attractive. Dividend stocks are particularly suited for this environment, as investors are rewarded for their patience.

In the short-term, economic data and comments from central bank officials are the largest sources of changes in a high-yield stock’s price. In the intermediate term, business conditions in the sector are most influential. On a long-term basis, changes in dividends and earnings drive the stock price.

Of course, high-yields can also be a distress signal when the underlying business is under threat and dividend payouts become deleterious to the company’s capital structure. These situations often arise when a dividend paying stock suffers a steep fall. This can temporarily make the dividend look attractive.

For example, as of July 2015, many oil stocks show up on scans for high-yield investment-grade stocks. However, this is more due to oil’s bear market, which drove down stock prices for the entire sector. An investment in these stocks is less of a bet on management’s ability to continue paying dividends and more of a bet on oil prices rebounding.

Therefore, investors have to expend considerable effort in determining whether a dividend is sustainable and stress test it for different scenarios. Additionally, interest rate risk is another consideration; rising interest rates lead to outflows, especially in high-yield stocks.

Read more: http://www.investopedia.com/articles/markets/081315/3-highyield-investment-grade-stocks-you-should-consider

http://www.newlonkong.com/English/home/index-or-individual-stocks/

What is the long-term relationship among share price, earnings, and price/earnings ratios?

An examination of some stocks in Singapore shows clear correlation, see the article at:

http://www.fool.sg/2015/02/13/is-singapores-stock-market-really-a-lousy-place-for-investors/